|

Assicurazioni |

Claims handling optimization and fraud detection for insurance companies in P&C, Life, Liability and Automotive

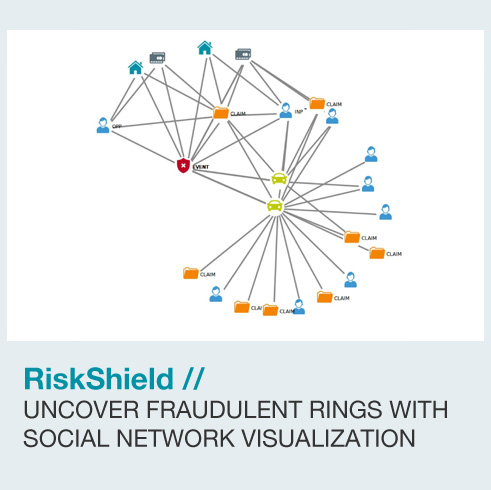

RiskShield intelligence claim evaluation software identifies legitimate claims automatically for fast track settlement and flags suspicious claims for further investigations.

RiskShield is a smart claim evaluation solution to optimize your claims handling process. As a supervised self-learning system, our decision engine automatically assesses the fraud risk of a reported insurance claim.

How does it work? An insurance claim automatically classified by RiskShield as inconspicuous can be settled faster and is more cost-effective, thus strengthening customer loyalty. The solution incorporates proven technologies such as fuzzy logic, pattern recognition, dynamic profiles and also supports external lists and databases to score claims quickly and effectively. Business rules can be enhanced and developed in real-time as new fraud patterns emerge, without any IT coding or system downtime.

Medical Billing and Healthcare fraud detection for insurance providers in workers' compensation and private health care

RiskShield automated software solution helps insurance companies to focus on suspicious claims, whereas the claims perceived by the software as unsuspicious can directly be settled without losing further time.

Insurance companies around the world today face the problem of how to deal with insurance fraud appropriately - in particular medical billing fraud. The aim is to present sophisticated claims investigators with a reduced number of highly suspicious claims for manual review. The incoming medical billing claims are analyzed to automatically extract claims that represent potential fraudulent activity or improper medical coding.

RiskShield assesses any fraud risk of individual incoming medical billing claims in real-time in matter of milliseconds and works transparently in the background. Upon receipt of a medical billing claim, the claims management system forwards it to RiskShield. The system uses rule sets and dynamic intelligent profiling to detect fraud patterns. Furthermore, RiskShield scores the medical providers based on the number of suspicious claims in which they are involved so that special attention can be given depending on their ranking.

Sirius Technology is Italian Partner of INFORM Software for: